As interest in car leasing grows from consumers, one brand leads the way. But there’s much more behind the story of the search results than perhaps meets the eye. Here are the four key findings from our vehicle leasing report.

A clear market leader in organic search.

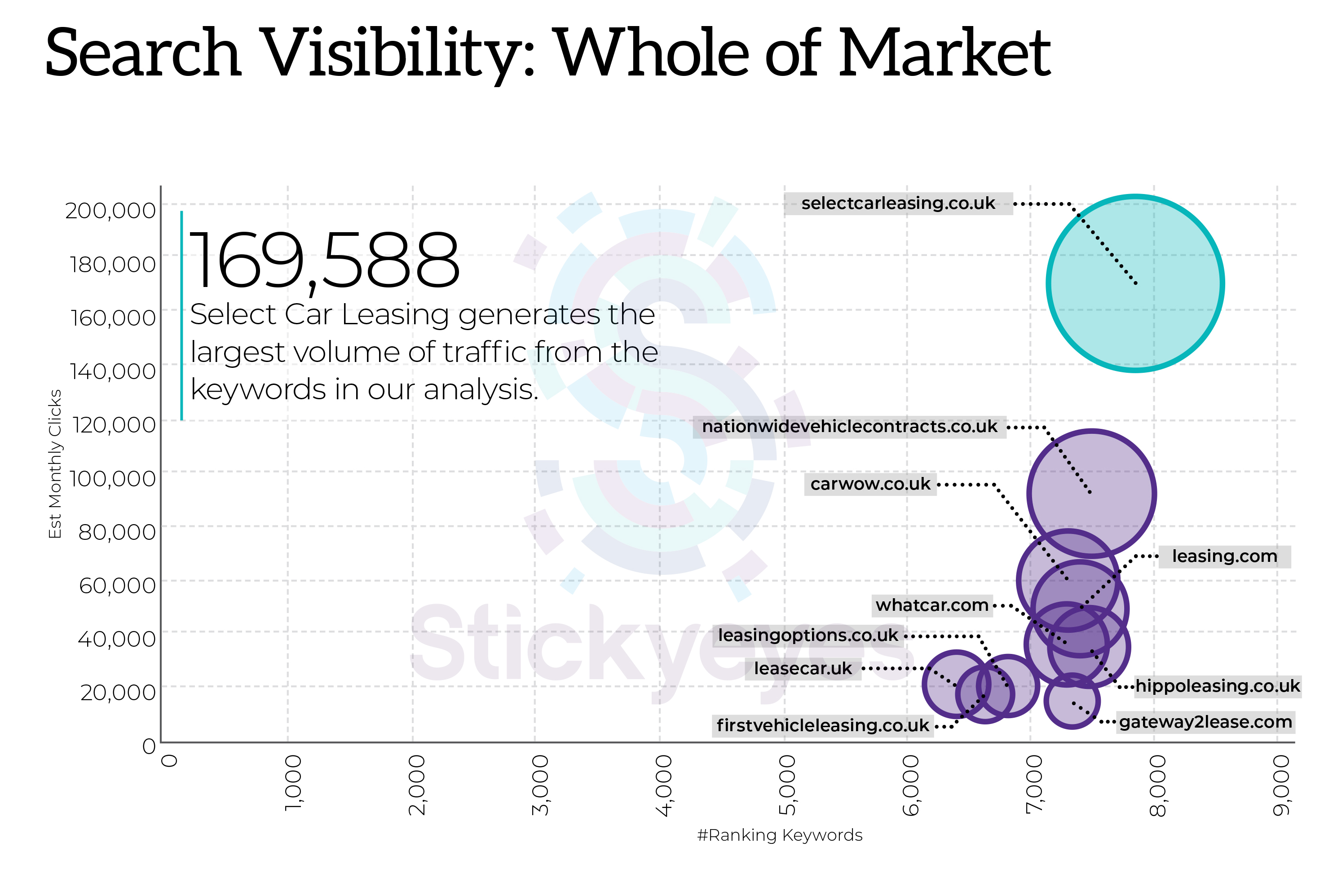

In the car leasing market, one brand is the clear leader. Select Car Leasing, according to our analysis, generates an estimated monthly traffic of 169,588 from organic non-brand keyword search. This is a significant lead over the second most-visible brand. Nationwide Vehicle Contracts, which has an estimated visibility of 92,175.

Select Car Leasing is the market leader in almost every segment in our analysis, with prominent rankings throughout the keyword set and position one rankings for 3,630 of the 7,926 keywords in our analysis, including the five biggest keywords in sector (“car leasing”, “car lease”, “lease car”, “car lease deals” and “lease cars”).

However, these five keywords account for just over 4.7% of the brand’s organic search traffic and generic keywords as a whole (generally the biggest keywords by search volume) account for less than half (49.8%) of Select Car Leasing’s traffic from organic search. The rest comes from keywords relating to specific manufacturers and vehicle models.

Select Car Leasing’s lead may not be as strong as it seems.

Our visibility data reveals where a brand is ranking in the organic search results and the traffic that it is likely to be enjoying as a result, but it doesn’t necessarily reveal why each respective brand ranks how and where it does.

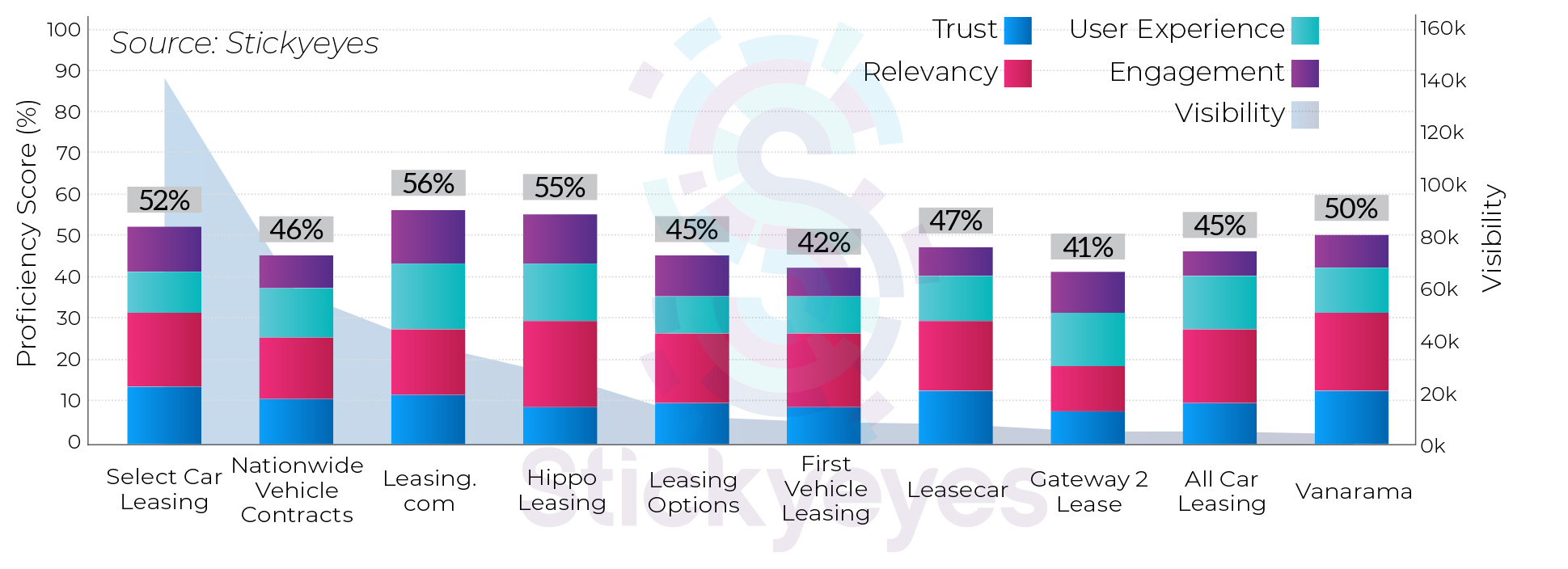

Knowing that there is a huge array of factors that can determine Google search rankings, we have a suite of in-house tools and data sets that can help us to understand the story behind the search rankings – effectively measuring various digital metrics to create a proficiency score.

In the case of the car leasing market this can be quite revealing because, considering what we do know about Google’s search ranking algorithms and measuring many of the metrics that we know play an important role in organic search performance, including trust, relevancy, user experience (UX) and engagement, we see that in many cases, Select Car Leasing is not as far ahead of the competition as the visibility data might suggest.

Select Car Leasing has a marketing proficiency score of 52%, behind two of its competitors and not that far ahead of most of the competition to explain how it commands such a huge proportion of the traffic.

So why does Select Car Leasing achieve so much more traffic that these brands and indeed, every other brand in the market? The answer may lie in where Select Car Leasing scores particularly well because whilst Leasing.com and Hippo Leasing may outperform the market leader in overall proficiency, Select Car Leasing does out-perform the market on one key metric; trust.

Ever since Google launched its EAT guidelines in 2018, the issue of trust has been high on the search agenda, particularly in sectors where there are high levels of consumer protections and regulations, such as financial services, so out-performing the competition on this metric would go some way to explaining Select Car Leasing’s strength in the market. For the competition, this is a key metric to focus on.

Some important issues for the competition to address.

It also should be noted that there is arguably a large degree of underperformance from many brands operating in this market and when look deeper into the analysis, we find some factors that could explain why Select Car Leasing’s lead in the market is larger than the marketing proficiency might suggest that it should be.

As well as identifying big variances in content depth, a closer look at some of this content also reveals that there are instances of duplicated content across different brands.

On closer interrogation of our analysis, we found examples of the same content being duplicated across multiple brands; an issue that can significantly impede a domain’s organic search ranking.

This content appeared to come from either from vehicle manufacturers (specifications or brochure content) or from content agencies (vehicle reviews), rather than from direct copying from competitors, but it highlights an aspect of search marketing where many of the brands in this sector are missing key opportunities to establish their expertise, build authority and establish consumer trust.

A market facing huge change brings big opportunity.

The UK automotive market has seen significant change in recent years, and this looks set to continue, as consumer demand, environmental influences and government policy combines to change the way in which the industry operates.

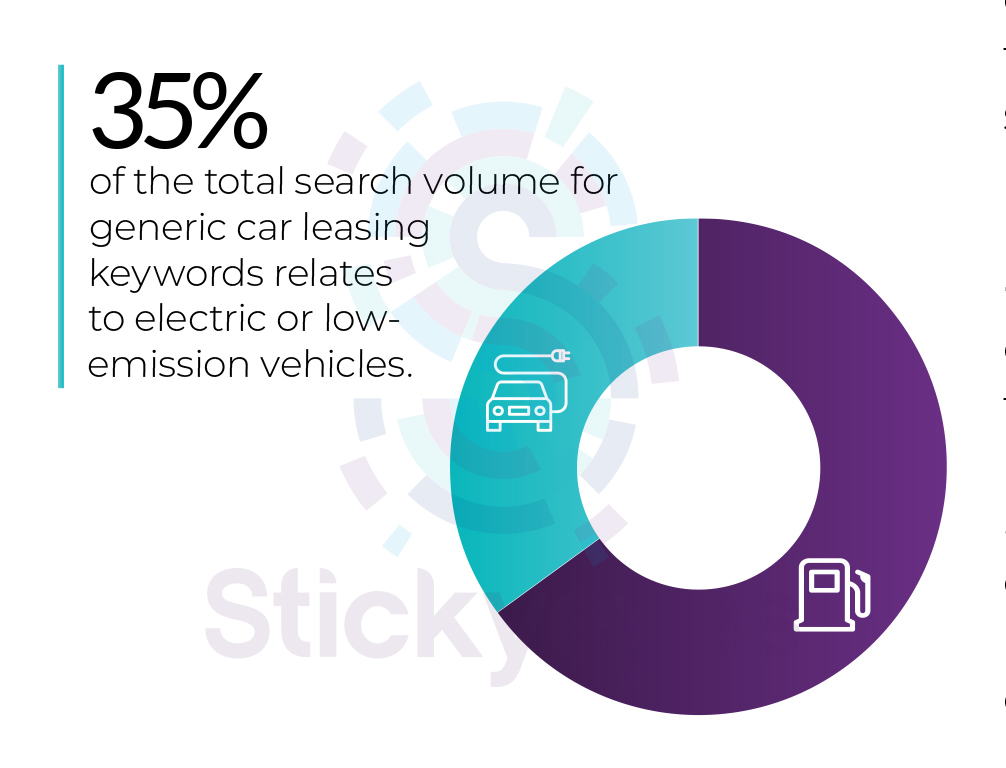

The vehicle market for electric and ultra-low emission vehicles (ULEVs) has grown considerably in recent years. Battery-electric powered vehicles saw a 184.3% increase year-on-year in September 2020 (SMMT), whilst more than a quarter of the 328,041 new vehicle registrations in September 2020 used some form of hybrid technology.

The increase in demand has been reflected in the search market, with searches for the term “electric car lease” reaching the highest point ever recorded at the start of 2020 and with the UK government bringing forward its commitment to phase out the sale of internal combustion engines to 2030, this is a trend that will only continue in the run-up to that date.

It means that electric and ULEV-related searches make up more than one third of the leasing market by search volume.

We have seen several brands already make moves to capitalise on this trend. One of the most visible brands in the electric car segment of the market is the utility provider EDF Energy, and those brands that put themselves in position early to build authority and relevance for electric vehicles will be the ones that get ahead of the competition as it invariably intensifies as the rate of ULEV adoption increases.