In the vehicle leasing sector, one brand seems to dominate the market. But why does Select Car Leasing command such a high proportion of the traffic from organic search? We explore three potential factors.

Select Car Leasing is the clear market leader in terms of search, outperforming its competitors by some considerable margin and dominating the search results in almost every segment of the leasing market.

So why does the brand enjoy such a dominant position in the market and, perhaps more pertinently, what does the competition have to do in order to close that gap and compete for organic search traffic?

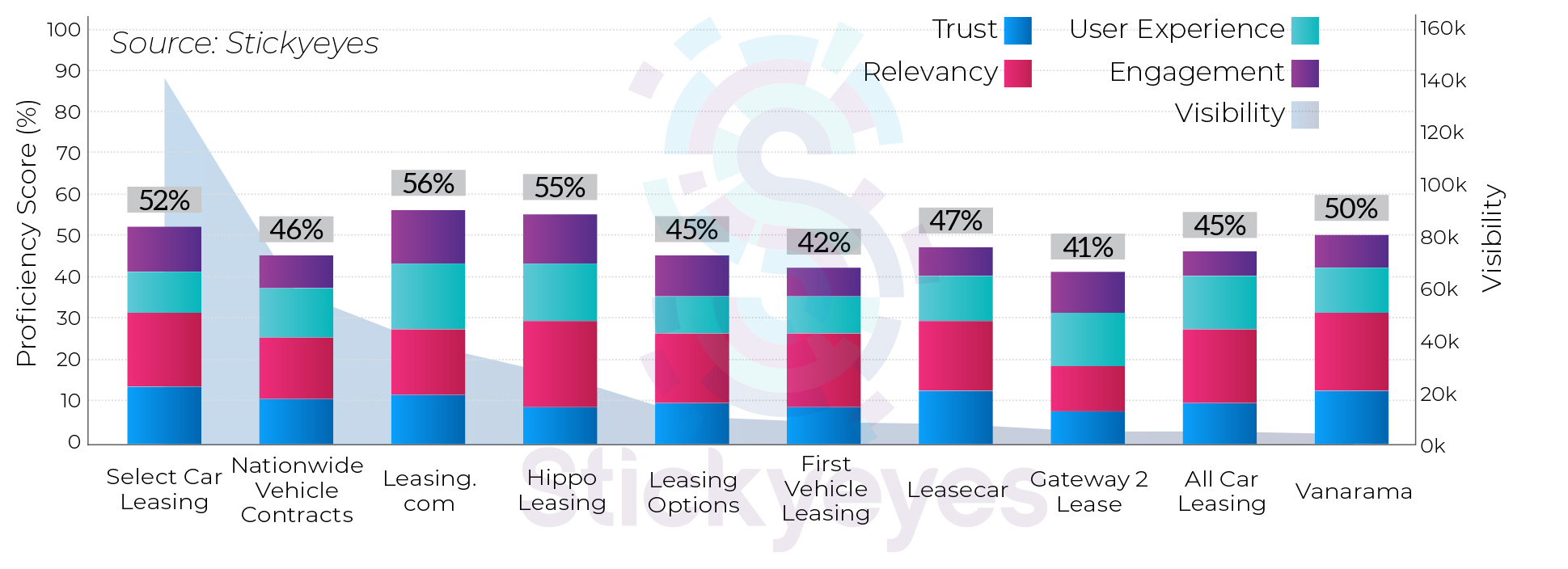

Whilst the visibility data reflects a brand’s traffic and its organic search rankings, it doesn’t necessarily reflect the strength of those rankings. The data doesn’t, in itself, reveal any particular insights into the search engine optimisation (SEO) strategy that has been deployed in order to achieve those rankings, nor does it show how susceptible they may be to increased investment in SEO activity from competitors. To understand this, we use a number of tools and data sources that better reflect a domain’s performance on key metrics that we know have an influence on organic search performance – namely trust, relevancy, user experience (UX) and engagement.

When we look at many of the metrics that we know play an important role in organic search performance, we see that in many cases, Select Car Leasing is not as far ahead of the competition as the visibility data might suggest.

Select Car Leasing has a proficiency score of 52%, putting it behind Leasing.com and Hippo Leasing in our analysis. So why does Select Car Leasing achieve so much more traffic that these brands and indeed, every other brand in the market? The answer may lie in where Select Car Leasing scores particularly well.

A brand that is trusted

One of the immediate standouts from the data is that whilst Leasing.com and Hippo Leasing may outperform the market leader in overall proficiency, Select Car Leasing does out-perform the market on one key metric; trust.

Whilst both Hippo Leasing and Vanarama out-perform Select Car Leasing on relevancy, they fall behind on key trust metrics. Leasing.com outperforms on the market leader on engagement and user experience metrics, but not on trust.

Our proficiency score measures trust by considering factors such as domain authority, linking root domains and brand awareness – relatively broad metrics in the context of search, but metrics that often combine many different elements and reflect a wide spectrum marketing tactics.

We know that trust is a big factor in Google’s search ranking algorithm, particularly when it comes to content that deals with complex financial products and services. Google’s ‘EAT’ guidelines, introduced in 2018, essentially raised the expected standards for branded content and other core trust signals, with Google’s search quality evaluators given new guidance on how to assess branded content in industries where there were higher standards and regulations in place to protect consumers. Google now expects higher levels of expertise, accuracy, balance and depth to branded content, which brings us onto the next area where Select Car Leasing performs well.

Good content depth

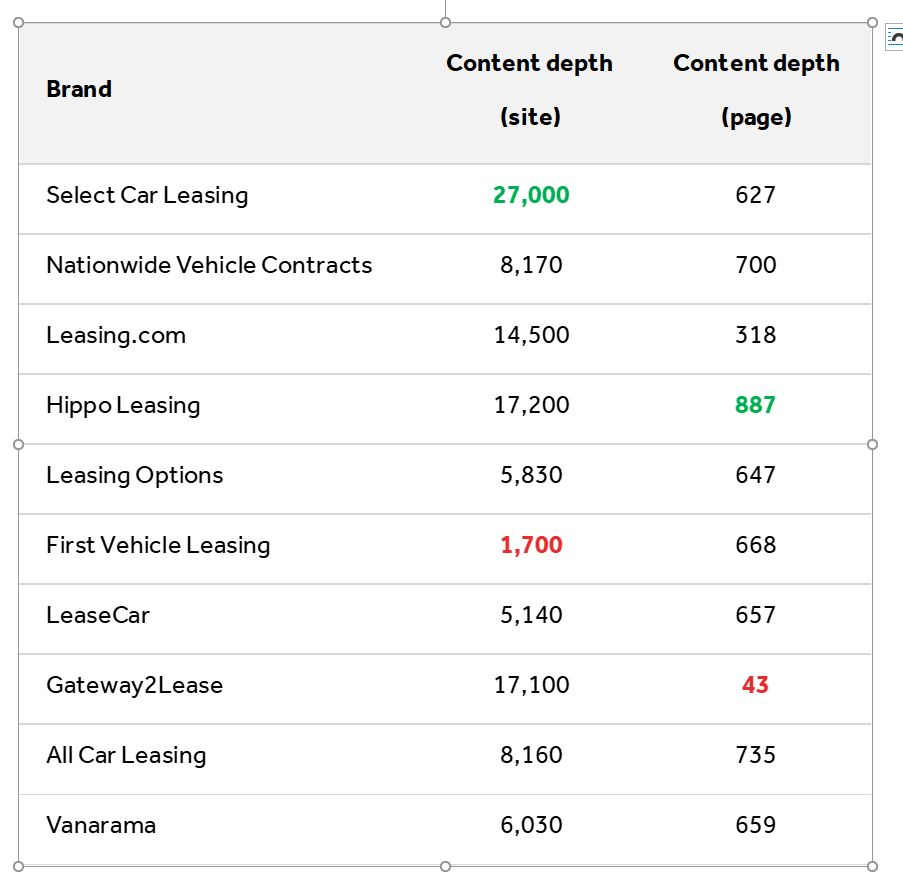

Select Car Leasing is also the market leader in content depth – a measure of the depth and length of content hosted across the site.

Whilst Select Car Leasing does not have the highest number of pages for the ten biggest leasing brokers that we analysed (Hippo Leasing leads that metric with 887 pages of content), it does by far have the largest content depth with around 27,000 words of content across 627 pages– around 10,000 words more than the nearest competitor.

This all supports the brand in not only establishing those important trust signals, but also in delivering a stronger, more informative user experience and establishing relevancy within this search niche. This is particularly important in a market such as vehicle leasing where a large proportion of the search volume comes from make and model-related keywords.

Underperformance from competitors, as well as some areas of concern

It also should be noted that much of Select Car Leasing’s performance comes from a degree of underperformance from many of its competitors.

The scale of the difference that the brand receives in organic search traffic compared to its competitors doesn’t necessarily reflect differences in marketing proficiency between the respective brands. Taking things at face value, whilst one might expect Select Car Leasing to remain the market leader, the size of the gap is bigger than our analysis suggests that it should be. This causes us to look deeper into the analysis, and this is where we find some factors that could explain the disparity in search visibility.

As well as identifying big variances in content depth, a closer look at some of this content also reveals that there are instances of duplicated content across different brands.

On closer interrogation of our analysis, we found examples of the same content being duplicated across multiple brands; an issue that can significantly impede a domain’s organic search ranking.

This content appeared to come from either from vehicle manufacturers (specifications or brochure content) or from content agencies (vehicle reviews), rather than from direct copying from competitors, but it highlights an aspect of search marketing where many of the brands in this sector are missing key opportunities to establish their expertise, build authority and establish consumer trust.