By: Tom Murray | Managing Director

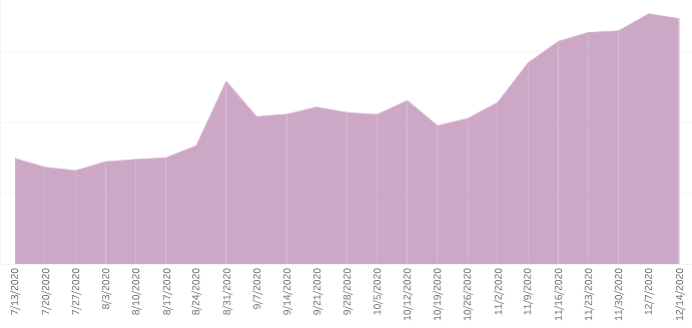

Check out the chart below. Any guesses what it is showing specifically?

Based on the article title, you might have been able to guess that it is a chart of Facebook’s CPM prices by week from July 2020 through mid December 2020.

From it’s low point in July, the highest weekly CPM we recorded in December was almost 3X higher than the low. These CPM increases are driven from various factors.

- Facebook Boycott: The boycott during the summer has completed, and while some brands are still paused, most have reactivated their campaigns. Some even only paused ads on Facebook and just shifted all their budget to Instagram for the PR play, but in reality didn’t spend any less. So CPMs were stable but then did spike in September once the boycotts were over.

- Q4 Pre-Testing: Many brands during end of Q3 and early Q4 start testing ads as well as build retargeting pools in advance of the bigger Cyber Week, which basically turned into Cyber Month deals for eCommerce. CPMs started spiking during the first week of November and kept rising. This was surprising, as everyone thought once the election was over, CPMs would drop for a few weeks, but in reality we saw the opposite.

- Speaking of the election… The US presidential and congressional elections pumped multiple hundreds of millions of dollars into the ad auctions, and the last weeks before the election ads made up over $100M per week.

- Shift from Brick & Mortar to Online: Many brands had to close up shop and shift to online shopping, which means a higher need for online ads to drive traffic to your site, as well as to create awareness of this big shift. eCommerce grew 10 years in the span of 10 weeks due to this massive shift in consumer behavior.

- Massive Increase in Facebook’s Total Number of Advertisers: Facebook had been adding around 1 Million advertisers a year consistently, but this year in just 9 months, they added 2 Million advertisers, bringing the total to 10 Million advertisers, mainly also due to point number 4 above. Because of this, more competition in the auction caused rising prices since ad load did not increase at the same rate.

All of these factors mean prices are only rising, and will be very likely to fall in the future. Of course, January CPMs will likely be lower, but it will still have a higher base than in the future.

What does this mean for Facebook? It means lower performance unless you can counteract the CPM with a similar rise in site conversion rate (CVR). This means focusing on creative as well as the user’s landing page experience will be the biggest way to keep Facebook campaigns performing in 2021.

Advertisers should also consider diversifying their spend away from Facebook to other channels if you have not started already. Social channels such as Pinterest and Snapchat are already taking advantage of this, but Google channels such as YouTube, Google Display & Discovery, and native channels such as Yahoo Gemini are primed to take advantage of these diversification efforts.