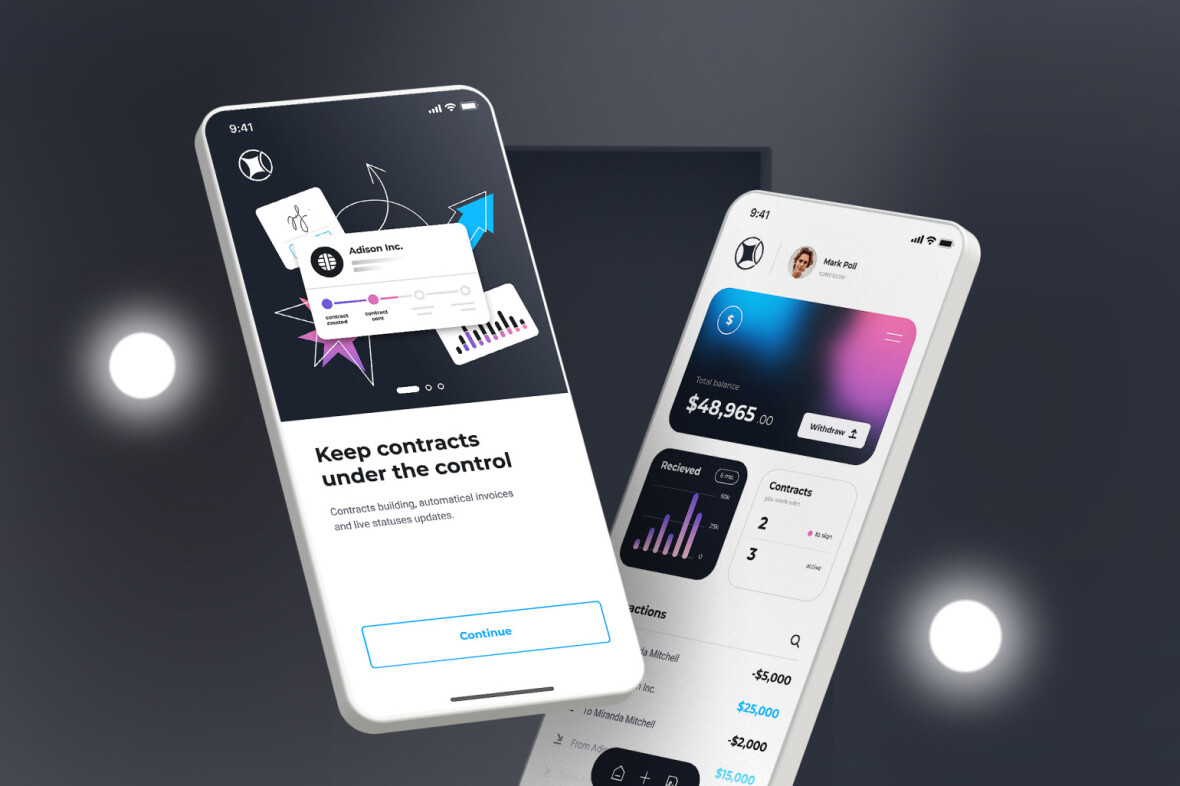

You might build a high-performance, smoothly running fintech app jam-packed with useful features; still, it’s never enough in our user-centric world. Today, user experience means everything for a fintech app’s success, making UI/UX design a crucial part of the development process.

Well-thought-out UI/UX design provides users with a rewarding digital experience, keeping them loyal to your app and brand and thus maximizing customer lifecycle value. Simply put, your financial product can’t do without engaging UI/UX design if you’re determined on success. In this article, we’re taking a closer look at fintech UX/UI design and sharing some hot tips and tricks on how to make your design pop.

What is fintech UI/UX design?

Fintech UX design is the process of creating a seamless user experience for financial apps, including banking services, personal finance apps, lending apps, insurance platforms, etc. UX design determines the user’s experience when interacting with your product and is responsible for the user’s overall satisfaction with your app.

UI design is closely connected with fintech UX design, but it refers to screens, buttons, icons, and other visual elements. In contrast, UX design involves users’ interaction with an app, including how they feel about it. In other words, UI is about the appearance of fintech products, while UX is about the content and features. Fintech UI/UX design involves the following aspects:

- functionality

- navigation

- user flows

- colour scheme

- content

- CTAs

- fonts

The importance of fintech UI/UX

With the fintech industry getting increasingly competitive and modern users expecting their experiences to be fast and intuitive, there’s no other way except creating a fintech UI/UX design that exceeds customer expectations. While user satisfaction is the ultimate goal of fintech design, there are some other solid reasons to back up its importance. Let’s check them out.

Smooth fintech design feeds into brand reputation

First impressions matter, and it goes without saying that first impressions about any app are design-related. A user-friendly interface and engaging user experience motivate users to come back for more and recommend your app to their families and friends.

Efficient product design boosts customer loyalty

User experience plays a vital part in establishing an emotional connection between the user and the product. Again, if users find your app helpful, easy to use, and pleasant to interact with, they’ll return to it.

Rewarding customer experience increases conversions and ROI

The perfect balance between the app’s usability, UI/UX design, and functionality inevitably leads to users loving to interact with your app. The more time a person spends using your app, the higher chances of getting them converted.

It takes a user just 0.05 seconds to form an opinion about an app or website, the first impression directly affecting bounce rates and revisits.

Top challenges in the fintech app UI/UX design and best practices to solve them

While fintech apps primarily focus on functionality and security, the app design is no less essential. Still, financial services occupy a rather specific niche in app development, which can make UI/UX design a challenging task. Here are the key challenges fintech user experience designers face, with practical tips on effectively tackling them.

Being too boring

Finance is a serious matter, challenging UI/UX designers to create something not too boring but still not overly laid-back. Your fintech app design doesn’t have to look like an insurance agreement — too strict design risks ending up too dull. Don’t be afraid to make your fintech design more fun and enjoyable.

Tips

- Stick to a minimalist colour scheme. Choose colours that align with your brand.

- Make sure the user flow is clean and cohesive.

- Ensure consistency in design.

- Leverage gamification to make using your app fun.

Overloading users with financial terms

The financial services sector is associated with a plethora of terms, most of which might sound strange to an average user, making UX writing a vital element in designing for fintech.

Tips

- Start with creating a termbase relevant to your target users.

- Make sure the language of your app is clear to both newbies and experts.

- Stay clear of jargon, acronyms, and complex terms.

- Prioritize non-specialist terms.

- Provide real examples to illustrate what you’re seeking to communicate.

- Where possible, explain processes, timelines, and requirements visually.

Too much information

The finance industry has a lot to talk about, but do fintech app users need to know all the ins and outs of finance? We guess no, and it would be better to show your expertise in a blog and keep your app simple. Information overload can overwhelm users and prevent them from coming back again. In addition, screens crammed with too much text escalate the cognitive load for users. Without any doubt, these aspects negatively affect customer experience.

Tips

- Keep things as concise as possible.

- Make sure your product features a flat learning curve.

- Make the app more personalized by incorporating contextual information architecture.

- Concentrate on the user journey rather than filling your app with information.

- Do your best to make onboarding quick and straightforward.

Overwhelming users with features

Today, fintech apps can include an incredible variety of features, from checking the balance to booking flights. However, it’s not a good idea to pack them all in a single app. Fintech products with too many features look (and feel!) messy and complicated, confusing users instead of helping them solve their problems.

Tips

- Create your app design with your audience in mind. For this, engage your target users in the design process, or hire a fintech design agency to carry out market research.

- Keep clear of unnecessary features.

- Make sure that specific features are displayed at the right moment.

- Include in-context guidance.

Passive user engagement

Unlike, let’s say, step counter apps, fintech platforms aren’t usually ones that users keep constantly checking. Most people tend to use their digital banking apps just to make payments. They usually overlook helpful services like managing personal finance or tracking spending offered by financial companies via the app. Still, this issue can be solved with the help of design thinking.

Tips

- Craft clear and powerful calls to action.

- Encourage users to try different services providing the right messaging at the right time.

- Notify customers of their achievements.

- Facilitate making informed financial decisions.

Lack of trust

Personal finance is quite a delicate matter, making the question of trust another big challenge financial institutions face when offering a digital product to their customers. However, it can be successfully addressed with the right UX/UI design solutions.

Tips

- Incorporate extra validation layers to boost users’ confidence and trust in your product.

- Ensure you add the right amount of friction to foster a sense of reliability.

Regulatory compliance

The financial industry is one of the most heavily regulated, requiring fintech companies to observe a range of regulations and restrictions to minimize the risk of fraud and financial crime. There are three major areas fintech designers have to consider:

- Cybercrime. While financial technology streamlines personal finance management and makes financial services more accessible, the same applies to hackers.

- KYC. Know Your Customer (KYC) is a financial services guideline that requires vendors to identify and verify their clients’ identities to protect both.

- AML. Anti-money-laundering (AML) is a set of policies, procedures, and technologies intended to avert disguising illegal funds as legitimate income.

Tips

- Add extra security features such as login limitations, password verifications, card number view restrictions, etc.

- Embed validation features, for example, address verification, AI-powered identity checks, or photo verification.

Fintech design trends

Smooth and intuitive UI/UX design can go a long way toward customer retention and loyalty, which translates into higher conversion rates. Let’s see which trends are dominating fintech UI/UX design.

Personalized interfaces

The ability to personalize the app interface has recently come into vogue, winning the love of many users. For example, customers can adjust the size of the widgets or switch between dark and light themes.

Biometric technology

Biometric technology helps to make fintech apps more secure and build customer trust, effectively tackling one of the critical design challenges. Biometric technology falls into two major types: physical and behavioural. While physical biometrics relies on physical features like fingerprints, voice, or facial recognition, behavioural technology is based on recognizing behavioural patterns that are impossible to replicate.

Gamification

Fintech UX designers work hard to make user experiences more enjoyable, which has resulted in gamification becoming one of the leading industry trends. For example, fintech app users can get virtual rewards for accomplishments and share their achievements on social media directly from their mobile banking app.

Vivid colours

To get a competitive advantage, fintech designers experiment with colours, bright interfaces being the most popular choice. Fair enough, since vivid colours are renowned for positively affecting users’ moods and forming solid associations with the brand. However, it is crucial to carefully select the colour scheme, keeping creativity and usability perfectly balanced.

Blurry backgrounds

Blurry backgrounds help achieve catchy and comfortable visual effects, bringing the foreground objects into focus and making them more noticeable. What is more, blur pairs well with any content type — image, video, or text.

Parting thoughts

Even a top-performing fintech app has scarce chances to survive in this intensely competitive market unless it focuses on the users. A well-thought-out UI/UX design can secure customer loyalty and trust, boosting your conversion rates and ROI. Although fintech design is associated with some industry-specific challenges, they can be easily tackled with the right approach.